The Current Real Estate Situation in Pakistan: Trends, Challenges, and Opportunities

Pakistan’s real estate market has always been a dynamic sector, attracting investors, developers, and homebuyers alike. However, over the past few years, it has experienced significant shifts, influenced by economic, political, and social factors. As the country moves through its economic challenges, real estate continues to play a crucial role in shaping Pakistan’s future. In this blog, we will explore the current real estate situation in Pakistan, its ongoing trends, key challenges, and potential opportunities for investors.

The Impact of Economic Factors

Pakistan’s real estate market is deeply intertwined with the country's overall economic situation. The country has faced macroeconomic instability in recent years, characterized by high inflation, fluctuations in the Pakistani Rupee (PKR), and an increasing cost of living. This economic environment has affected the real estate market in several ways:

- High Inflation and Construction Costs: Inflation has significantly raised construction costs. Materials like cement, steel, and labor have become more expensive, making new housing projects more costly. This has resulted in developers shifting their focus to high-end properties to maintain profitability, leaving the middle and lower-income segments under-served.

- Impact of the Exchange Rate: The devaluation of the Pakistani Rupee has made foreign investments in the real estate market more expensive. This has impacted the overall demand for high-end residential and commercial properties, especially in metropolitan areas like Karachi, Lahore, and Islamabad.

- Interest Rates and Mortgage Market: The State Bank of Pakistan’s monetary policy, which has kept interest rates relatively high, has increased the cost of home loans. This has reduced the affordability for potential homebuyers, especially first-time buyers. Consequently, there’s been a rise in cash transactions and a decrease in mortgage financing.

Trends in the Real Estate Market

Despite the challenges, the real estate sector in Pakistan has shown resilience. Some key trends in the current market include:

- Luxury Real Estate Boom: Over the past few years, there has been a notable increase in the development of luxury residential projects. High-end apartments, villas, and gated communities are seeing growing demand from the upper-middle-class and affluent buyers. The demand for these luxury properties is being fueled by individuals looking to secure their investments and expatriates seeking a safe and comfortable place to return to.

- Gated Communities and Smart Cities: With rising security concerns, there is an increased demand for gated communities and high-security housing projects. These developments offer not just security but also modern amenities like parks, shopping malls, and healthcare centers. Furthermore, with the rise of technology, smart cities and smart homes are emerging as a significant trend, offering advanced infrastructure and automated living solutions.

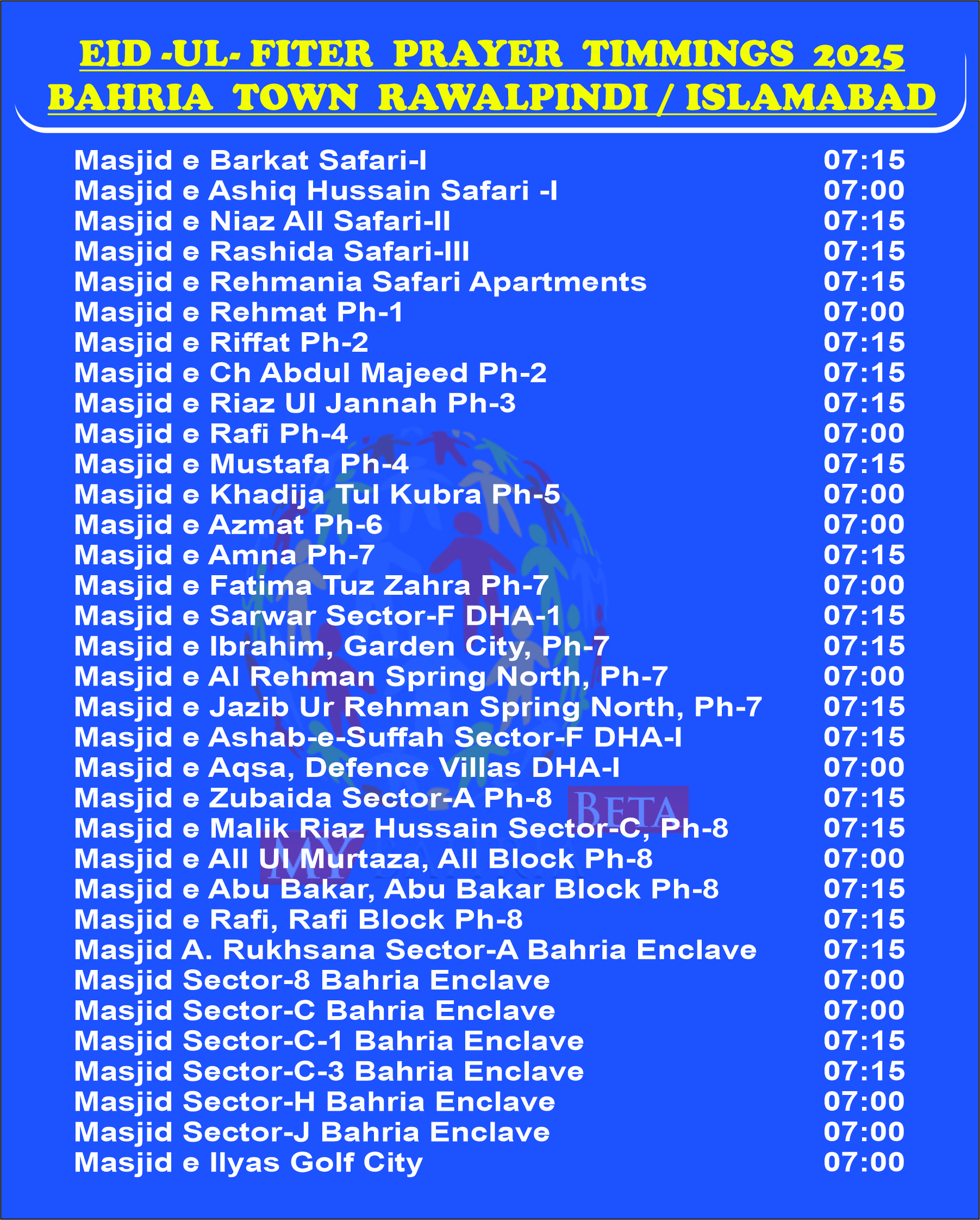

- Urban Expansion and Infrastructure Development: As Pakistan’s cities grow, so does the demand for housing. Infrastructure projects, such as new highways, metro systems, and airport expansions, have increased the value of real estate around these areas. The expansion of Islamabad’s housing schemes like DHA, Bahria Town, and Gwadar’s real estate market are some examples of how infrastructure development plays a pivotal role in driving demand.

- Rise in Commercial Real Estate Demand: In cities like Lahore, Karachi, and Islamabad, commercial real estate is thriving, particularly in the form of high-rise buildings, office spaces, and retail centers. The commercial sector is expected to continue growing, especially as the country recovers from the pandemic and businesses expand their operations.

- Emergence of Real Estate Investment Trusts (REITs): A notable development in Pakistan’s real estate market is the rise of Real Estate Investment Trusts (REITs), which allow small investors to pool resources and invest in large-scale commercial and residential properties. These have the potential to democratize real estate investment, making it accessible to a wider audience.

Challenges Facing the Real Estate Market

While the market has its growth areas, there are several challenges that continue to hamper its full potential:

- Lack of Affordable Housing: One of the most pressing issues in Pakistan’s real estate market is the lack of affordable housing for the masses. With a growing population and a large segment of people living in informal settlements, there is an acute shortage of affordable housing solutions for lower and middle-income groups.

- Regulatory and Legal Issues: The real estate market in Pakistan is marred by a lack of proper regulations and an inefficient legal framework. Issues like property disputes, delays in approval processes, and unclear land titles make it difficult for investors and developers to operate with confidence. The government's efforts to streamline these processes through initiatives like the National Database and Registration Authority (NADRA) have had limited success.

- Speculation and Price Volatility: Real estate in Pakistan has long been a speculative market, with investors buying properties to sell them at a higher price, often with little regard for actual demand. This speculative behavior has led to periods of rapid price increases followed by crashes, leaving many investors vulnerable to market corrections.

- Political Instability: Political instability has historically been a major factor affecting Pakistan’s real estate sector. The uncertainty surrounding government policies, taxation, and the broader political environment can make long-term investments risky. Changes in leadership, taxes, and land regulations can drastically impact the market’s growth and investor confidence.

Opportunities in Pakistan's Real Estate Market

Despite the challenges, there are several opportunities for both local and international investors:

- Investing in Emerging Cities: While cities like Karachi, Lahore, and Islamabad remain prime real estate hotspots, emerging cities like Gwadar, Multan, Faisalabad, and Rawalpindi are showing signs of growth. Infrastructure projects, such as the China-Pakistan Economic Corridor (CPEC), are creating new opportunities in these regions, making them attractive for investors looking for long-term gains.

- Affordable Housing Projects: Given the high demand for affordable housing, developers who focus on providing cost-effective residential solutions stand to benefit. Government incentives and public-private partnerships are expected to increase in this area, especially with initiatives like Naya Pakistan Housing Scheme and other similar projects.

- Retail and Hospitality Sector: The retail and hospitality sectors are also experiencing growth, with Pakistan’s expanding middle class and rising tourism driving demand for commercial spaces, hotels, and resorts. High-quality retail centers and boutique hotels in major cities offer lucrative opportunities for investors.

- Sustainable and Green Real Estate: With growing awareness of environmental concerns, the demand for sustainable and green real estate is expected to increase. Developers who focus on energy-efficient buildings, eco-friendly materials, and sustainable urban designs will likely see higher demand from both consumers and investors.

Conclusion

In conclusion, Pakistan’s real estate market is currently navigating a complex landscape. Economic instability, regulatory challenges, and affordability issues persist, but there are significant opportunities for growth, especially for those willing to look beyond traditional urban centers. By focusing on emerging markets, sustainable development, and affordable housing, developers and investors can position themselves for success in a market that holds tremendous potential.

As Pakistan’s economy stabilizes and urbanization continues, the real estate sector will remain a critical pillar of the country's economic development, offering both risks and rewards for those involved.